What if your most eco-friendly product is also your most toxic one?

While most sustainability conversations fixate on carbon emissions, a growing number of forward-thinking companies are discovering that actual environmental impact lies far beyond the carbon footprint. Consider a compostable food wrapper that leaches harmful chemicals into the soil, or a smartphone component that contributes to freshwater pollution thousands of miles from the end user. These aren’t outliers—they’re examples of how overlooked impact categories, such as toxicity, land use, and eutrophication, can reveal blind spots in product design and supply chains. As businesses strive for more credible sustainability strategies, tools like Life Cycle Assessment are becoming essential, not just for quantifying emissions, but also for exposing the less visible yet equally critical environmental trade-offs.

The Carbon Tunnel Vision

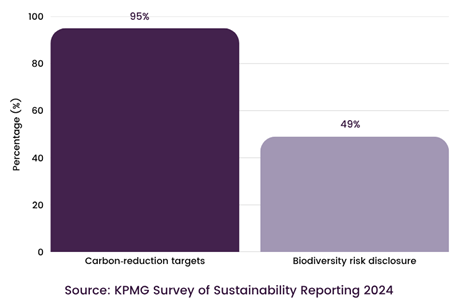

Corporate scorecards overflow with carbon data, but they still overlook many other environmental impacts. Research indicates that carbon-focused reporting is becoming nearly universal, with 95% of the world’s top 250 companies having set explicit reduction targets, yet far fewer reveal metrics on biodiversity, water, or land-use pressure. Regulators and investors are starting to broaden their perspective, but many frameworks and rules remain centered on carbon, which experts refer to as “carbon tunnel vision.” As our Comprehensive Guide on Lifecycle Assessment explains, the way you draw system boundaries often determines whether impacts such as land use, toxicity, and eutrophication remain invisible.

Why a Life Cycle Assessment Beats Carbon-Only Accounting

Corporate greenhouse-gas accounting took off because it is quantifiable, comparable, and increasingly mandatory. In KPMG’s 2024 global survey, 95% of G-250 firms report carbon-reduction targets, up from 80% just two years earlier. Overall, sustainability reporting is almost as widespread; however, drilling down reveals a sharp imbalance: only 49% of these companies disclose biodiversity-related risks. The result is a one-dimensional picture that obscures the impact of other materials.

Analysts have coined this imbalance “carbon tunnel vision,” warning that it limits companies’ ability to spot trade-offs and value-creation opportunities across their supply chains.

Regulations that reinforce the tunnel

Policies have certainly raised the bar for climate data, but most remain emissions-heavy and light elsewhere:

- SEC climate-disclosure rule (US): Finalised in 2024, it centres on carbon metrics and, after legal pushback, dropped any requirement to report Scope 3 (supply-chain) emissions.

- EU Corporate Sustainability Reporting Directive (CSRD) – From FY 2024, large and listed EU companies must report via ESRS under a double-materiality lens. EU regulators have deferred sector-specific standards on pollution, biodiversity, and resource use for up to two years, so carbon disclosures remain the most prescriptive element.

- State-level laws, such as California’s SB-253, likewise begin with carbon footprints before expanding to broader ecological indicators.

The net effect: Businesses receive a strong compliance signal to count their tonnes of CO₂ but only a weak nudge to quantify eutrophication potential or chemical toxicity.

Market Signals Pointing Beyond Carbon

Investor interest is pivoting faster than regulation. A 2023 WWF survey found that 83% of institutional investors believe companies should disclose their impacts on biodiversity. Meanwhile, corporate biodiversity reporting through CDP increased by 43% in 2024 alone, signalling growing peer pressure to provide multi-impact data. Task-force initiatives like the TNFD now encompass organisations controlling more than $20 trillion in assets, adding further momentum.

Business implications of a narrow lens

Focusing sustainability budgets solely on CO₂ can mask other “hotspots” that erode value:

- Reputational risk—claims of a “carbon-neutral” product can backfire if toxicity or land conversion impacts surface later.

- Regulatory lag—frameworks such as CSRD are expanding; companies that only track carbon now may face costly data-collection scrambles later.

- Capital access—investors pricing nature-related risks could re-rate firms that cannot demonstrate performance on broader metrics.

By recognizing the limitations of carbon-only dashboards, leaders position themselves to anticipate broader disclosure demands and design products that truly reduce overall environmental burden, not just their emissions footprint.

The Hidden Categories: What Lifecycle Assessment Truly Measures

Lifecycle standards used in Europe and elsewhere now monitor 16 separate midpoint impact indicators—only one of which is climate change. Three others include human and ecotoxicity, while additional indicators measure land-use change, eutrophication, water use, resource depletion, and other stresses. When companies expand their assessment boundary, these “background” indicators often reveal environmental hotspots that surpass or even negate the improvements seen in carbon metrics.

Toxicity risks loom just as large: Analysts project the US$5.7 trillion chemical sector will double by 2030, expanding the pool of hazardous substances that carbon metrics never capture, meanwhile China’s rare-earth hub of Baotou, source of over 80% of the nation’s reserves, faces cancer clusters linked to radioactive mining waste.

A café chain switched to corn-based, compostable cups to reduce CO₂ emissions.

A Life Cycle Assessment revealed that upstream fertiliser runoff would discharge 12 tons of phosphates into local waterways each year, enough to trigger harmful algal blooms in nearby freshwater. Switching to recycled-paper cups reduced the eutrophication potential by 68%. (Source)

A multi-impact LCA lens detects these hidden hotspots early, enabling companies to redesign products before regulators or investors flag the damage. A multi-impact LCA lens detects these hidden hotspots early, enabling companies to redesign products before regulators or investors flag the damage.

For a deeper look at how EcoDesign makes those redesigns stick, see How EcoDesign Transforms Product.

From Insight to Action

Investors and regulators are already broadening their perspective: CDP reported a 43% increase in companies disclosing biodiversity data in 2024, indicating a growing demand for metrics beyond just carbon. Over 500 organizations, managing roughly US$17 trillion in assets, now back the TNFD, integrating nature-related risks into financial decision-making.

Europe’s CSRD has merely postponed sector-specific standards on pollution and land use by two years, not abandoned them, so the push for multi-impact reporting continues. As companies prepare, forecasters expect the LCA software market to nearly double to over US$1 billion by 2030, reflecting the rising demand for comprehensive assessments. Firms that consider toxicity, land occupation, and eutrophication now will be better positioned for future scrutiny and can uncover cost savings and risk mitigation opportunities that their carbon-only competitors overlook.

Need Help Discovering Your Hidden Hotspots?

Evalueserve IP and R&D’s Environmental Sustainability and Toxicology Consulting Services combine lab-grade hazard data with advanced modelling to flag unseen impacts across your product portfolio and supply chain.

Download our latest whitepaper, Enhancing Product Sustainability through LCA & EcoDesign for executive checklists, real-world metrics, and a roadmap to turn those insights into profitable, compliant design wins—and let us help you apply them from day one.

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.