The internal combustion engine (ICE) has long been the backbone of global mobility, powering everything from personal vehicles to freight fleets. But the tides are turning fast. With tightening emissions regulations, ESG mandates, and the rising cost of fossil fuels, the automotive and transport sectors are under mounting pressure to decarbonize and diversify their energy mix.

As mobility leaders recalibrate their strategies for a post-ICE era, three dominant alternatives are emerging: electric vehicles (EVs), hydrogen fuel cells, and advanced biofuels. Each offers a unique value proposition and distinct trade-offs in infrastructure readiness, scalability, total cost of ownership, and environmental impact.

The critical question isn’t just which is cleaner and brighter for your business model, use case, and long-term growth.

This article’ll cut through the hype and compare EVs, hydrogen, and biofuels, anchored in real-world data, industry use cases, and forward-looking insights. Whether managing a logistics fleet, advising on infrastructure investments, or rethinking vehicle procurement, this guide is designed to help you make strategic, future-proof decisions.

1. The Post-ICE Landscape – Why Change Is Inevitable

Mobility is undergoing a structural transformation. Governments worldwide are phasing out new ICE vehicle sales: the EU has targeted 2035, while significant states like California aim for 2030 (Green City Times). ESG commitments, air quality regulations, and customer preferences accelerate the transition.

At the same time, the pressure to reduce operational costs and improve energy efficiency is pushing businesses to explore cleaner technologies. Investors are also increasingly linking company valuations to sustainability metrics, including Scope 1 and 2 emissions.

In short, decarbonization is no longer a compliance issue. It's a strategic imperative.

2. EVs – Electrifying the Urban Core

EVs have rapidly become the frontrunners in the clean mobility race. Battery electric vehicles (BEVs) offer high energy efficiency, zero tailpipe emissions, and are increasingly cost-competitive. Global EV sales accounted for nearly 20% of new cars in 2023, led by markets like Norway (over 90%) and China (around 40%) (Our World in Data).

They shine in urban contexts—think delivery fleets, rideshare vehicles, and municipal transport—where daily ranges are predictable and charging infrastructure is more accessible. Expansion of charging networks, especially in Europe and China, is key (IEA Global EV Outlook 2024).

That said, EVs still face barriers. Charging infrastructure remains unevenly distributed, charging times can impact vehicle uptime, and raw material supply chains for batteries (lithium, cobalt) face geopolitical and ethical scrutiny.

Sector Snapshot – Urban Logistics & Municipal Fleets EVs are ideal for city-based logistics hubs and municipal bus fleets. Many cities are deploying low-emission zones, making EV integration wise and necessary for last-mile competitiveness.

Use case fit: Urban delivery, passenger mobility, corporate fleets.

3. Hydrogen Fuel Cells – Powering the Long Haul

Hydrogen fuel cell electric vehicles (FCEVs) are carving out a niche in heavy-duty transport. With fast refueling times and long ranges, hydrogen is well suited for long-haul trucking, buses, and rail. Fuel cells also perform better than batteries in extreme cold and under continuous heavy loads.

The catch? Infrastructure. Green hydrogen production remains expensive, and fueling networks are nascent. As of 2024, global hydrogen refueling stations grew modestly, but are still far from widespread (ScienceDirect).

Still, cost curves are improving. High-volume fuel cell system costs have dropped from $200/kW in 2021 to about $155/kW in 2023 (US Department of Energy).

Sector Snapshot—Freight & Industrial Transport Hydrogen is gaining serious traction in long-haul freight corridors across Europe and East Asia. Pilot programs with hydrogen-powered rail and mining vehicles also test feasibility in heavy industrial sectors.

Use case fit: Long-haul freight, regional buses, industrial mobility.

4. Biofuels – The Retrofit-Friendly Middle Path

Biofuels provide a pragmatic bridge between today’s ICE infrastructure and tomorrow’s green mobility ecosystem. Fuels like biodiesel, ethanol, and advanced synthetic blends can power existing ICE vehicles with little to no modification.

This makes them especially relevant in aviation, agriculture, and marine transport sectors where electrification is less feasible in the near term. Biofuels can be made from waste biomass, improving their sustainability profile (NREL).

However, concerns persist around land use, food security, and the true carbon neutrality of some feedstocks. Regulation and certification will play a significant role in determining their long-term viability. The sustainable aviation fuel (SAF) market alone is projected to reach $16.8 billion by 2030 (BusinessWire).

Sector Snapshot – Aviation, Maritime & Agriculture Airlines and shipping companies increasingly integrate sustainable biofuels to meet net-zero pledges. In agriculture, biofuels offer a cost-effective retrofit option for tractors and machinery where electrification isn’t practical.

Use case fit: Aviation, maritime, agricultural fleets, ICE retrofits.

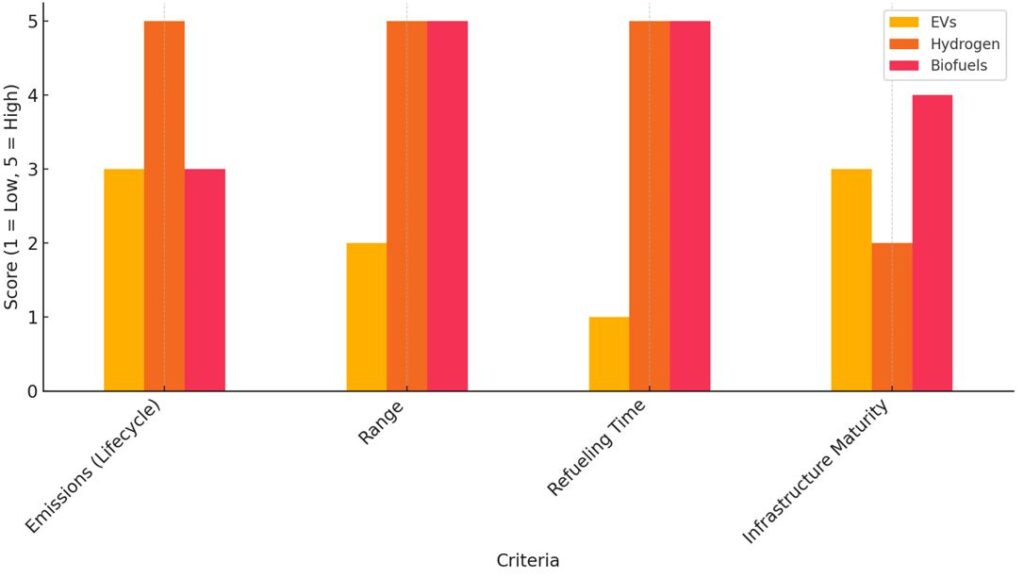

5. Comparative Snapshot: Matching Tech to Mission

|

Criteria

|

EVs

|

Hydrogen

|

Biofuels

|

|---|---|---|---|

|

Emissions (Lifecycle)

|

Low

|

Very low (green)

|

Medium

|

|

Range

|

Moderate

|

High

|

High

|

|

Refueling Time

|

Long

|

Short

|

Short

|

|

Infrastructure Maturity

|

Growing

|

Early-stage

|

Medium (existing)

|

|

Best Fit

|

Urban, light-duty

|

Heavy-duty, long-haul

|

ICE-dependent sectors

|

6. Future Outlook – No Silver Bullet, But a Smarter Arsenal

The future of mobility will be diverse and dynamic. No single technology will dominate all sectors. Instead, the most successful players will optimize across technologies based on use case, policy landscape, and customer needs.

EVs will continue to dominate urban and light-duty segments. Hydrogen will expand where uptime and range are mission-critical. Biofuels will serve as a vital decarbonization lever in legacy and hard-to-electrify segments.

Innovation is accelerating across the board—from solid-state batteries and green hydrogen breakthroughs to next-gen sustainable aviation fuels. The key is to stay flexible, informed, and aligned with market signals and sustainability goals (McKinsey).

Conclusion: Time to Act, Strategically

In the post-ICE era, the real question isn't which technology wins but how to win with the right mix of technologies. Businesses in the mobility space must begin planning not just for compliance but also for competitiveness.

Evaluate your fleet profile, pilot alternative drivetrains, and engage with policy and infrastructure developments. In the race to sustainable mobility, first movers will not just comply—they will lead.

Talk to One of Our Experts

Want help developing a multi-pathway roadmap?

Connect with mobility strategists, energy advisors, and infrastructure experts to co-design your next move. Because the future of mobility won’t wait—and neither should you.