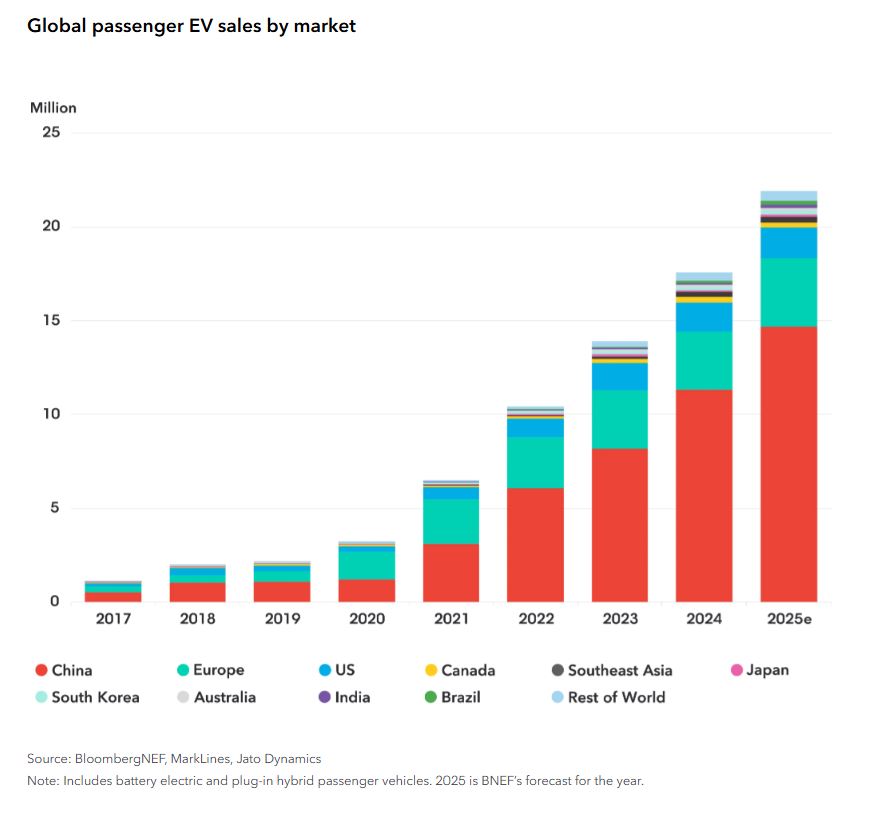

The electric vehicle (EV) revolution is no longer a theoretical horizon—it’s unfolding at speed. Yet, while global EV sales are set to grow 25% year over year in 2024, the U.S. is emerging as a surprising laggard, potentially dragging global adoption with it.

According to BloombergNEF’s Electric Vehicle Outlook 2024, the U.S. is expected to sell 14 million fewer EVs between 2025 and 2030 than previously forecast, with the rollback of key policy supports, such as tax credits and federal fuel standards, cited as the primary cause. At a time when electrification should be accelerating, policy instability is introducing friction into the gears of progress.

This isn’t just a national issue. U.S. inaction affects global supply chains, investment flows, and innovation strategy. As traditional automotive powerhouses pause, others are pulling ahead—fast. Companies can’t afford to wait for legislative certainty—they need real-time innovation and IP insight to navigate this split-speed world.

Global Disparity: The New Reality of EV Competition

While the U.S. reevaluates its regulatory posture, China is decisively leading the way. It produced over 70% of the world’s EVs in 2023 and has created a consumer market where EVs are, on average, cheaper than their internal combustion counterparts. Europe continues to benefit from long-term incentives and emissions mandates. Meanwhile, emerging markets like Thailand, India, and Brazil are investing heavily in EV infrastructure and localized production.

In this new order, the assumption that EV adoption begins in wealthy economies no longer holds. BNEF’s forecast shows China accounting for two-thirds of global EV sales by 2025, with Europe contributing 17% and the U.S. just 7%.

In short, innovation is migrating to where it’s most wanted.

Strategic decisions must now be based on a globally aligned view of technology, regulation, and IP, rather than domestic forecasts alone. EV leaders are increasingly relying on dynamic, multi-jurisdictional patent and technology mapping, such as that powered by Evalueserve’s IP and R&D practice, to track competitors’ moves and stay ahead of shifting innovation centers.

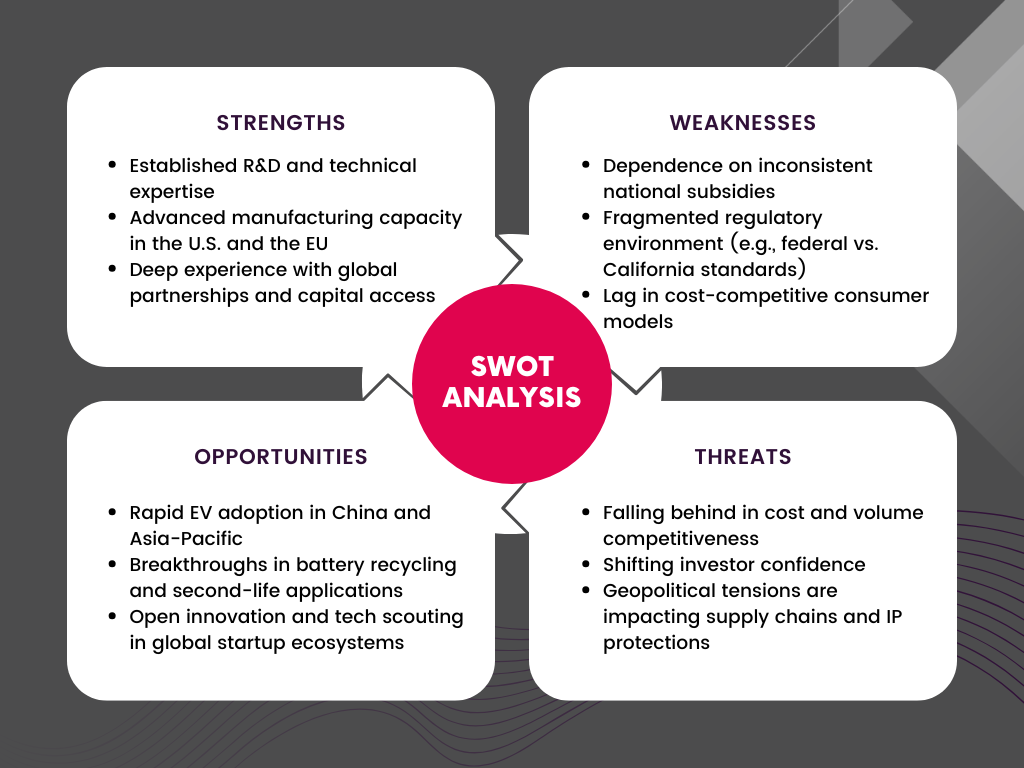

What’s at Stake: A Strategic SWOT for EV Providers

To assess what this changing landscape means for innovation-focused providers, a SWOT analysis reveals key tensions and possibilities:

The message is clear: those who rely on old playbooks and policy cushions risk being disrupted. Providers must instead focus on agile innovation, cross-border partnerships, and a global IP strategy.

Where Innovation Can—and Must—Happen

EV providers, OEMs, and component manufacturers have powerful levers at their disposal—but they must be pulled with intent and precision. Below are three high-impact innovation zones that can unlock strategic value:

Localized, Cost-Efficient Vehicle Platforms

As price remains a significant barrier to adoption, innovation should prioritize modular, cost-reduced EV platforms tailored to specific markets. Chinese OEMs, such as BYD and Wuling, are outperforming global incumbents by tailoring their engineering to meet the needs of emerging markets.

Case in point: Wuling’s Hongguang Mini EV became one of China’s best-selling vehicles—priced under USD 5,000, it was designed for urban use cases and local tastes.

Strategic priority: Conduct teardown analyses and cost benchmarking to adapt vehicle platforms and supply chains for targeted affordability.

Battery Lifecycle Innovation and Second-Life Models

The next frontier is not just battery performance—it’s lifecycle value. Battery recycling, materials recovery, and reuse in stationary storage are becoming strategic pillars in sustainability, compliance, and circular economy models.

Example: Companies like Redwood Materials and Li-Cycle are investing in scalable battery recycling ecosystems to close the loop on raw material dependency.

Strategic priority: Invest in innovation scouting and regulatory foresight to stay ahead of battery lifecycle legislation (e.g., EU Battery Regulation 2023).

Evalueserve’s innovation scouting teams specialize in identifying emerging recycling technologies, second-life applications, and regional compliance triggers across the U.S., the EU, and the APAC region.

Combined with Life Cycle Assessment (LCA)-enhanced patent landscaping, these insights help companies prioritize both regulatory alignment and competitive differentiation.

Global IP and Regulatory Intelligence

In a fragmented policy world, static IP strategies won’t survive. Innovation portfolios must be aligned with region-specific value—what is patentable and enforceable in China differs drastically from what is strategic in Europe or the U.S.

Observation: With China dominating EV production, IP filings at CNIPA (China’s IP office) now serve as early indicators of technology trends, and companies must closely monitor the portfolios of Chinese players.

Strategic priority: Build data-driven IP intelligence dashboards that track shifts in competitor filings, enforcement environments, and licensing opportunities across jurisdictions.

Evalueserve IP and R&D enables this agility through IP landscaping and regional trend analytics, helping IP teams make region-specific decisions that support business strategy, avoid costly infringement, and seize licensing opportunities.

Why Innovation Must Lead, Not Follow

The key message for leaders: policy is no longer the primary driver—market agility and innovation foresight are.

Waiting for regulatory clarity in the U.S. risks ceding the next decade of leadership to faster-moving ecosystems. Meanwhile, batteries are getting cheaper, manufacturing capabilities are decentralizing, and global consumers are becoming more EV-ready—without waiting for federal mandates.

In the absence of top-down direction, companies must go open partnering, scouting, and innovating across borders and sectors.

Final Thought: Strategy Needs a New Compass

For EV ecosystem providers, innovation isn’t just an R&D function—it’s a strategic compass. It guides market entry, competitive positioning, compliance risk, and long-term value creation.

The current inflection point—marked by policy regression in the U.S. and aggressive acceleration elsewhere—demands that innovation become proactive, borderless, and deeply integrated with business decision-making.

Those who wait will follow. Those who innovate will lead.

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.